Software (NPL, UTP) - Solution for NPL management

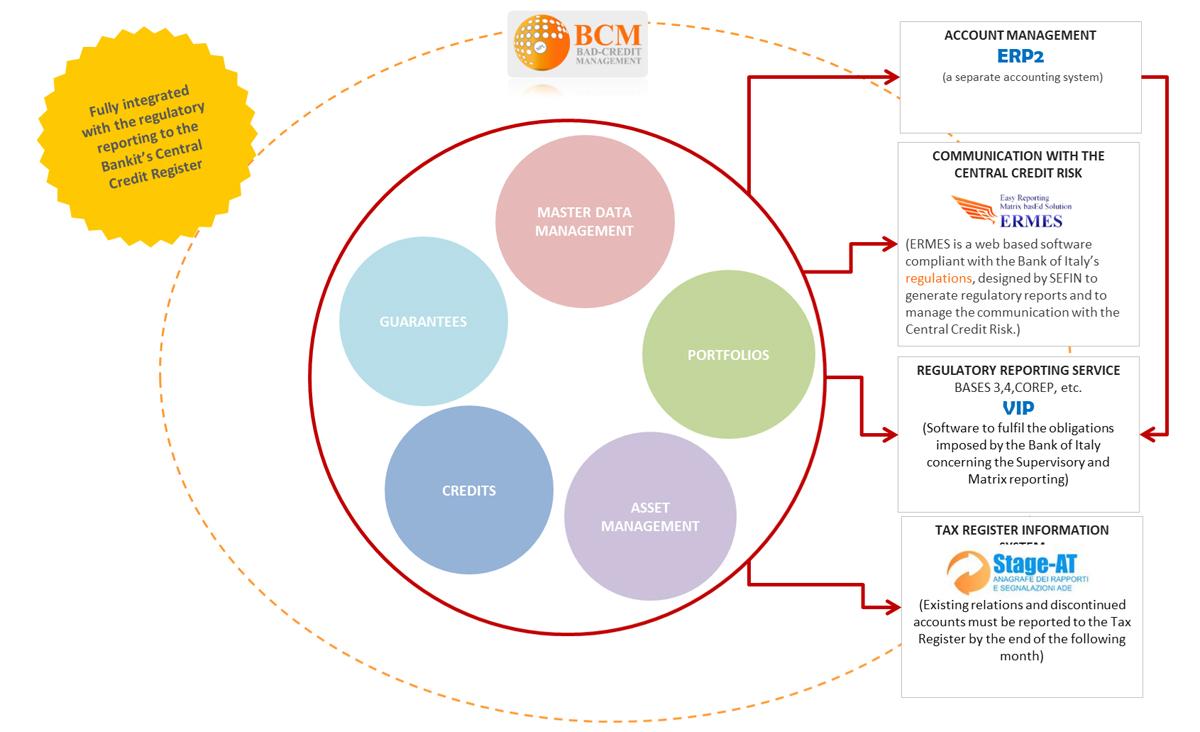

Bad Credit Management through workflows manages debt recovery of distressed loans integrating the personal, accounting and management components into a single platform. The system manages the progress of the individual credit recovery activities and the recovery assignee. Each area of the software allows the operator to supervise and manage all aspects of a dossier in terms of workflow, including the legal information of the assigned debtor such as legal and extrajudicial events.